Most retailers know that the profitability of their business is crucial if they wish to survive in the market, but there are still plenty of brands out there who don’t know how to calculate the profit margin for their business.

Here, we’ll guide you through the process of determining your profit margins and share some tips on how to increase earnings at your brick and mortar store.

What does profit margin mean?

In the most basic sense, profit margin indicates the percentage of money derived from the sale of products or services that is left over to the business as income.

To better illustrate this point, it is useful to distinguish between two common terms: Gross profit margin and net profit margin.

Related: 15 Key Metrics (KPIs) to Measure Retail Store Performance

Gross profit margin is used to indicate the total amount of sales revenue you have left once you deduct production and acquisition costs, which are known as the Cost of Goods Sold (COGS). It’s important to note that the revenue used to calculate your gross profit margin is the amount of money your retailer earns before any operating costs and taxes are subtracted.

Gross Profit Margin = {(Revenue – COGS) / Revenue} x 100

By contrast, operating profit margin indicates the percentage of every dollar spent at your store that translates into operating profit (or profit before taxes) for your business.

To calculate the operating profit margin, you must know your operating income, which is the profit your business turns after deducing the COGS as well as other operating expenses – but still before paying taxes.

Operating Profit Margin = (Operating Income / Revenue) x 100

Let’s say your business brought in a revenue of $100,000 one weekend, but the cost of goods sold accounted for $20,000. That would bring your gross profit margin for that weekend to:

($100,000 – $20,000)/$100,000 x 100 = 80%, which is quite a high profit margin.

Now, let’s say your operating income for that same weekend was $40,000, once you factor in the $20,000 for the COGS and another $40,000 for other expenses like staffing and bills. That would mean your operating profit margin for that weekend is:

($40,000/$100,000) x 100 = 40%, which differs significantly from the gross profit margin but offers a more accurate representation of your business’s financial standing at that particular point in time.

What is the average profit margin for retailers?

There are a lot of factors that impact the profit margins of retailers, from product quality to supply chain operations, marketing costs and even customer service. Yet even with all these variables, there are certain industry averages every retailer should know.

According to Vend’s 2019 Benchmarks Report, wherein the brand studied more than 13,000 retailers, the average gross profit margin in retail is 53.33% worldwide.

Related: How to Calculate (and Increase) Retail Conversion Rate

According to the same study, the highest profit margins in retail came from beverage manufacturers (65.74%), jewelry stores (62.53%) and cosmetics brands (58.14%), while alcoholic beverage retailers (35.64%), sporting goods stores (41.46%) and electronics stores (43.29%) experienced some of the lowest profit margins.

Regardless of which category you fall under, we’ve got some actionable ideas to help you boost profit margins at your business.

1. Be smart about the discounts you offer

When aiming to increase your profit margins, your aim should be to avoid markdowns and discounts as much as possible.

Sure, a last-minute sales campaign with a hefty discount might land you enough money to pay your bills on time, but it won’t help – and could very likely hurt – your business in the long run.

One way to eliminate the need for discounts to move extra products from your store is to have your entire stock visible. If that is not an option for your retailer, you can also implement a Product Information Management (PIM) tool that provides standardized information about the products you have in stock, both online and in-store.

Using PIM software can help retailers track valuable information about each product they sell, which in turn enables them to make more guided decisions about pricing (more on this below).

Related: 15 In-Store Promotion Tactics to Increase Retail Sales

If markdowns are inevitable for your business – as may be the case for retailers that sell perishable items such as food – you can also take advantage of AI-powered dynamic pricing solutions to offer the right discount at the right time, thus helping you to maximize your profit margins.

Last but not least, you can look at past data to analyze your customers’ purchasing behavior and tailor your discounts accordingly.

For instance, if you find that your customers’ average transaction value didn’t change whether you offered them a 5% or 10% discount, you may choose to only offer 5% discounts from now on, or you may find that offering free shipping instead of discounts is a better solution for your business.

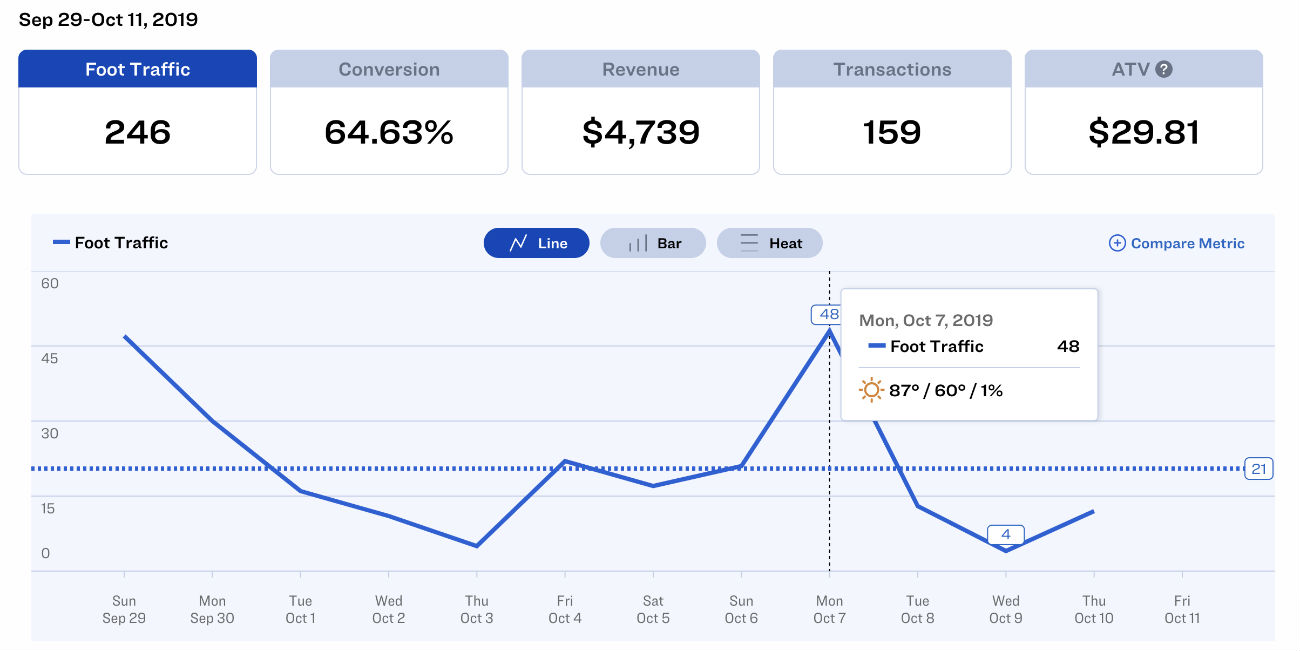

Click here to discover how a people counting solution like Dor can help you understand your store's ATV and other important metrics on a single screen.

Related: People Counters & People Counting: Everything You Need to Know

2. Increase the perceived value of your brand

One way to boost your profit margins without overhauling your product range is to elevate your brand perception in the eyes of consumers.

Lifestyle-oriented brands are particularly adept at curating a “persona” for their brand through smart messaging, captivating store signage and enticing packaging – just look at any high-end cosmetics company and you’ll begin to understand how important it is to distinguish yourself from other brands that offer similar products.

Even if you’re not a cosmetics giant, you can still get customers to view your brand differently by focusing on aspects of your business that aren’t directly related to sales.

The right solution will vary from one retailer to the next, but some ideas could be switching up the look of your store, investing in more alluring packaging or teaming up with influencers to promote your brand.

Another fail-safe way to improve brand perception in your customers’ eyes is to focus on offering exemplary customer service. By training your staff well, you can make them an asset for your business. If your customers know that they will be met with attentive, knowledgeable salespeople every time they walk into your store, not only will they become loyal customers, but chances are they also won’t mind spending a few extra bucks to receive the star treatment.

3. Boost your average transaction value

Speaking of well-trained salespeople, you may be glad to know that they are your best resource to boost profit margins. You want people who are well-informed about your product range assisting your customers, as they can take advantage of this opportunity to cross-sell or up-sell products.

For instance, if a customer is in your electronics store looking for a new smartphone, an experienced salesperson can convince that customer to spend more than they originally intended and buy a phone in a newer model (up-selling), or your salesperson can recommend accessories and related devices that would improve the customer’s experience using his or her new smartphone (cross-selling).

You could even turn this exercise into a game for your employees by setting sales targets and having them compete to beat them, perhaps with a small reward at the end. By motivating your salespeople to up-sell and cross-sell, you’ll get customers to spend more each time they visit your store, which would increase your average transaction value (ATV) – which, in turn, increases your profit margin.

Related: How to Calculate (and Increase) Average Transaction Value in Retail

Another way to boost ATV with the goal of increasing profit margins is to be thoughtful about your in-store product placement. By locating impulse purchases and smaller but intriguing items near the cash register, you give your customers one last chance to buy something before they proceed with payment for their items.

4. Reduce operating expenses

Routinely examining operating expenses to see where costs can be minimized or eliminated is something that all retailers should do, but for those looking to increase profit margins, it is a must.

One of the first changes you can make is to cut excess staffing at your retailer. An easy way to do this is to install a foot traffic counter, which will provide you with data on what times and days are busiest at your store so you can make sure to have enough staff on hand for those times.

Click here to discover how a people counting solution like Dor can help you understand your store's busiest hours and other important metrics on a single screen.

You can also review the tasks assigned to your existing staff and see if you can switch around their roles to highlight their talents – if an employee is really good with people, you would rather have him or her chatting up customers, not stuck in the back doing inventory.

Another way to reduce operating expenses is to see which parts of your business can be automated to save you time and labor costs. By investing in POS software that readily displays retail analytics such as inventory management data and sales metrics, you can eliminate the need for specialized personnel to do things like data entry and analysis.

Using data in this way will also help you see where losses occur in your business, whether it’s due to an inefficient supply chain, too much stock kept in-store or another factor. Correctly assessing this information will enable you to reduce wastage at one or multiple points throughout your business, thus increasing your profit margins.

5. Build rapport with your vendors and suppliers

Take another look at your supply chain. Are you spending too much money on transporting products or supplies to your store? If so, it’s time to get in touch with your suppliers to see if you can work out another solution.

If at all possible, you should try to consolidate your vendors into one or a few. If that’s not an option, you can also try to combine orders with other retailers in your region to lower transportation costs. Yet another option is to buy products in bulk if you have the space to store them.

For most brick-and-mortar retailers, building rapport with vendors and suppliers is key. Not only will it give you a chance to ask for vendor discounts or flexible payment options, but a close relationship with your supplier will also enable you to set and work towards some common goals to improve profit margins at both businesses.

6. Eliminate products with low profit margins from your stock

As we mentioned earlier, incorporating retail analytics into your business can help you easily see the gross profit margin on individual products throughout your store.

By minimizing or altogether eliminating products with the lowest profit margins from your stock, you can focus your time, energy and money on products that yield higher returns for your business.

As a general rule of thumb, products with a markup of less than 20% can be considered to have a low profit margin. These products are often inexpensive and easily replaceable, and sometimes they can be generic alternatives to name-brand goods.

The most common examples of products with low profit margins are personal hygiene products, household chemicals, baby food and accessories. If selling these products is not essential to your business, try eliminating them from your next order and see how your customers respond to the change.

7. Increase prices

Most retailers are reticent to raise prices for fear of losing the customers they already have, but sometimes it’s the only way to increase your profit margins.

If you haven’t altered your prices in a while, it’s a good idea to check out what the competition is doing so you aren’t underselling your products. You must also consider economic factors at large, such as inflation.

Related: 5 Time-tested Techniques to Improve Your Stores' Sales

One of the most important factors affecting your pricing will be how your customer base approaches money. Take a close look at their spending habits. If you find that your customers are choosing your store more for the experience than the discounts, they’ll likely stay as long as you continue to offer them the same top-notch service they won’t find elsewhere.

Another thing to consider is that you don’t have to raise prices across the board. You could try raising the profit margin on a group of products to see how your customers will react. A smart way to do this would be to mark up select items and market them as a more high-end alternative to your usual product range. You may even find that customers prefer this segment due to their perceived value of the products in it.

In other words, it just might be a big hit!