Time to take notes!

Here are the best pricing tactics to take your business to the next level.

But first...

What’s retail pricing?

Retail pricing is a core aspect of any business that sells products to customers. After all, consumers may care about a number of factors when making purchasing decisions, but the price they will pay for an item is almost always among their top concerns.

When it comes to setting prices for products offered at your retailer, there are numerous approaches you could take, depending on your short- and long-term business goals. However, generally speaking, the retail price you set for any given item must include the cost of that item plus any markups you make in order to gain a profit from selling that item.

This pricing approach can be summarized with the basic formula:

Retail Price = [(Cost of item) / (100-markup percentage)] x 100

So, if an item cost you $0.50 to manufacture, and you hope to sell it with a 50% profit, your retail price would be:

[(0.50) / (100-50)] x 100 = $1.00

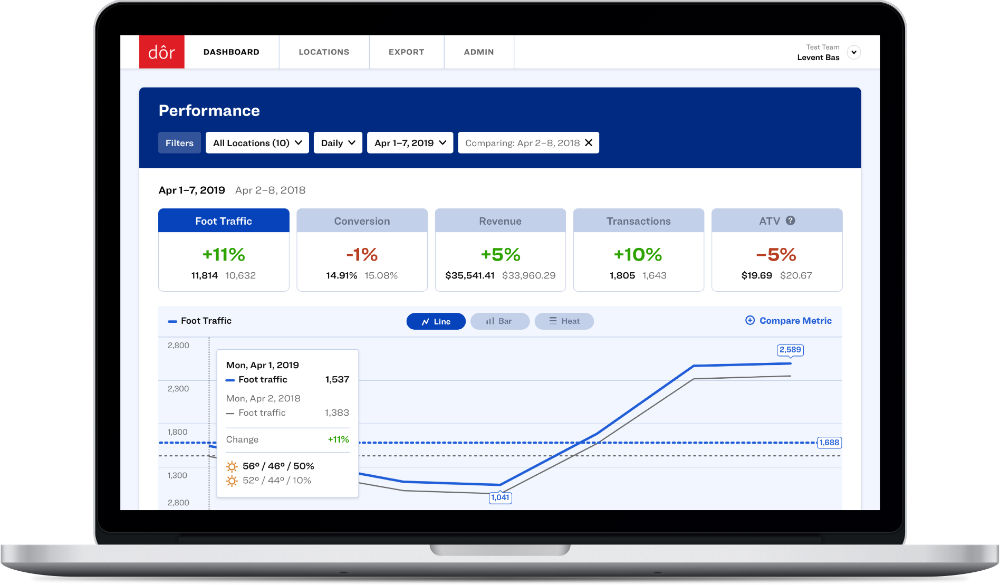

Click here to discover how a people counting solution like Dor can help you understand your foot traffic data and how to utilize it to make more profitable business decisions.

Ready to purchase? Complete your purchase in just minutes!

Related: People Counters & People Counting: Everything You Need to Know

What are your retail pricing objectives?

It should come as no surprise that every retailer seeks to maximize profits and keep profit margins high.

Yet the world of retail is hardly stable, and your priorities as a business can shift over a matter of weeks or months. Depending on the type of retailer you manage or the time of year, your biggest objective may just be keeping your store afloat for a few months until you can draw in more customers during the high season.

Related: 7 Proven and Working Ways to Increase Profit Margins in Retail

When setting the retail pricing objectives for your retailer, it’s important to consider factors besides just profit margins and markup percentages.

The easiest way to do that is to ask plenty of questions.

- What is your brand’s mission?

- What are your future plans as a retailer?

- Who are your core group of customers?

By answering these questions truthfully, you can begin to get a sense of what matters to you in the short and long term. After all, a retailer looking to achieve large profit margins in the short term to finance the opening of new stores will have a vastly different pricing objective than a luxury brand that wishes to keep its products coveted by consumers.

Factors that affect retail pricing

Although retail pricing is a complex topic with many different components, the factors that affect how you price your products can be broadly categorized as either internal or external.

Internal factors are elements of your business that are generally under your control, such as the costs and processes associated with manufacturing, or how much you invest in promotions and marketing. Internal factors are important because they give you an idea of your baseline, or how much you must earn from retail sales to keep your business profitable.

External factors, on the other hand, are largely out of your control. These factors include the proximity and price range of your competitors or the buying power of your consumers. When assessing external factors, it’s important to consider macro trends such as the current state of the national, regional, and global economy, as they hugely impact customer purchasing behavior.

Related: 40 Ideas to Boost Retail Foot Traffic and Increase Sales

12 commonly used pricing strategies

Let's have a deep look at the most common pricing strategies that are used by retailers.

As mentioned above, every pricing strategy has a different outcome for short and long term with different strategies and different objectives.

1. Manufacturer Suggested Retail Price (MSRP)

This pricing strategy is perhaps the most familiar for consumers. The idea behind the Manufacturer Suggested Retail Price (MSRP) is to standardize the prices of products sold across multiple locations, and it is often used for mass-produced items like consumer electronics or household appliances.

This approach can also be referred to as cost-based pricing, since it takes into account the cost of manufacturing the product, a profit margin for both the manufacturer and the retailer, as well as the prices of similar products. Generally, the manufacturer provides the products to the retailer at roughly half the MSRP, enabling the retailer to turn a profit from the sale.

Pros: This approach takes the guesswork out of price-setting for retailers, saving them time and energy.

Cons: Offering certain products at the MSRP can lower your competitive edge on those particular products—after all, if you offer the same item at the same price as other retailers, how do you set yourself apart?

2. Keystone pricing

Keystone pricing is essentially doubling the wholesale or production cost of a product to determine the retail price.

This practice actually stems from the MSRP, which, as we mentioned, is generally double the wholesale price.

Pros: Similar to the MSRP, this approach saves retailers time and energy, as it doesn’t require too many calculations to determine the retail price of a product.

Cons: Although keystone pricing may work for some items, it won’t work for all of them. For items that are truly worth more, you may be setting the price too low, which means you won’t achieve the profit margins you feasibly could on that item. For other items, keystone pricing may be too high, which will end up hurting your sales—especially if there is a nearby competitor selling the item for cheaper.

Related: 15 Key Metrics (KPIs) to Measure Retail Store Performance

3. Bundle pricing

Also known as multiple pricing, bundle pricing is when you sell a group of products for a single price—think three-pack socks or five-pack underwear.

Retailers often prefer bundle pricing because it streamlines their marketing campaigns, as they have to promote a single price instead of several price points. Customers also love bundle deals, since they believe they’re getting more bang for their buck.

Pros: Bundle pricing often leads to larger-volume purchases of certain products or product groups, so if you have unsold inventory you’re trying to move, this could be a smart tactic to employ.

Cons: Once you offer items in a bundle package at a low cost, it can be harder to sell them separately at their original price. This is due to what is called cognitive dissonance, whereby the consumers believe they’re getting less value for the amount they pay because they’re comparing it to the bundle deal that was previously available (even if the bundle deal was more expensive than the individually priced item).

4. Discount pricing

As the name suggests, discount pricing is the practice of selling products at a discount, whether it’s through sales codes or coupons sent directly to the customer or through in-store discounts or even store-wide markdowns. Although retailers don’t love the idea of discounting items as it generally eats into their profit margins, offering the occasional sale can do wonders for getting more people into your store and attracting new groups of customers who are out looking for a deal.

Pros: Discount pricing can be a great way for retailers to get rid of slow-moving or out-of-season items.

Cons: If you offer discounts too frequently, it can lower your brand’s perceived value in customers’ eyes, making them unwilling to pay full price for your goods and services.

5. Penetration pricing

Often preferred by newer brands who are set to enter the market, penetration pricing is the practice of initially keeping product prices low so as to introduce the brand and its products to as many people as possible.

The idea is that by generating word of mouth among consumers, retailers can save on advertising and customer acquisition costs down the road.

Pros: Offering lower prices than the established competition can help retailers strike the right chord with shoppers, helping them to build a loyal customer base from day one.

Cons: If you make the switch from your initial low prices to regular pricing too abruptly, it has the potential to backfire and alienate the customers you had acquired by that point.

6. Loss-leading pricing

This is the approach of luring customers in by offering a discount on a product they want, then encouraging them to buy more products along with the original one once they’re in your store.

By using the loss-leading pricing, retailers hope to offset their profit loss on the discounted item by selling additional products the consumer hadn’t initially thought of buying.

Pros: This approach often increases the average transaction value (ATV), or the amount a shopper spends in a single shopping trip.

Cons: When it comes to implementing loss-leading pricing, it’s crucial to strike the right balance in customer service. Just as you don’t want your customers to feel forced by staff to purchase items they don’t need, you also don’t want to risk losing money by only selling the discounted items and not much else.

7. Psychological pricing

Although the concept may sound like something out of a research paper, we all encounter psychological pricing on a daily basis.

Also known as “charm pricing,” this approach relies on the theory that customers place greater trust in prices that end with odd numbers like 5, 7, or 9, the last one being the most popular. So, instead of offering an item for a rounded $200, the retailer may choose to price it at $199, and customers will perceive this to be a better deal based on the number alone.

Pros: Psychological pricing is especially useful for brands that want to increase their overall sales volume by driving customers to make impulse purchases of cheap to mid-range items.

Cons: Not all brands should implement psychological pricing. In fact, if you’re a premium or luxury brand, implementing psychological pricing can have the opposite of the intended effect in that it makes you seem “cheap” or “gimmicky” in the customers’ eyes.

Related: How to Calculate (and Increase) Average Transaction Value in Retail

8. Competitive pricing

As the name suggests, competitive pricing is the practice of using your competitors’ prices as a benchmark and setting your prices lower. Again, retailers who take this approach hope to offset their reduced profit margins by increasing the total volume of sales.

Pros: For large retailers who are able to negotiate deals to lower their unit costs, the competitive pricing approach can really make a difference in getting ahead of the competition.

Cons: For smaller retailers, the only way this practice can be sustainable is to ensure that you sell high volumes of the product. Also, depending on the product, it can make customers think of your brand as the discount alternative to other brands.

9. Premium pricing

The opposite of competitive pricing, premium pricing is when you choose to offer your items at a higher price than the competition.

Pros: When combined with the right marketing tactics, this approach can help your brand be perceived as a “premium” or luxury brand.

Cons: Depending on your target customer group, premium pricing may not be the way to go. There are many factors at play here other than a product’s price and perceived value, such as your customers’ buying power, the quality of your competitors’ offering, or even your geographical location.

10. Anchor pricing

Anchor pricing is the approach of placing both the discounted and the original prices of an item side-by-side to give the customer an idea of how much they’re saving.

This method creates what’s known as an anchoring cognitive bias, where the customer considers the listed original price as the reference point in evaluating whether to buy the discounted item.

Pros: Listing the anchor price along with the discounted price makes the customer feel like they’re getting a deal, which can serve as an incentive to buy the item.

Cons: Don’t be tempted to increase your anchor price to an unreasonable level. Keep in mind that consumers are much savvier today than they used to be, and thanks to the prevalence of smartphones, they can access your competitors’ prices in just a few seconds.

11. Channel-based pricing

Channel-based pricing is a relatively new approach that’s applicable for omnichannel retailers or simply those that sell their products across multiple channels like brick-and-mortar store, website, and social media accounts. With this method, retailers set different price points for the same product based on where it’s sold.

Pros: For retailers looking to promote one channel over another—say, to drive their e-commerce operations or to draw more people into stores—channel-based pricing can be used as a great incentive for customers to choose that particular channel.

Cons: Customers may feel outright cheated if they see that you offer the same product at two distinct price points. One way to get around this is to keep prices the same but offer a channel-specific discount, one that’s applicable only online or only in-store.

12. Wholesale pricing

Wholesale pricing is often used by retailers who sell their products to other businesses (B2B) instead of directly to the customer (B2C). In some cases, the same retailer can offer prices at the MSRP to the customer and at a discounted wholesale rate to other retailers, who then sell these products to the customer for a profit.

To set the wholesale price, you must first calculate the cost of goods manufactured (COGM), which includes both material and labor costs as well as additional costs like transportation and overhead expenses. Then, you must factor in the profit margin, which should be at least 50%, before setting your wholesale price.

Pros: Offering products at wholesale is a great option for retailers looking to move large quantities of slow-moving inventory, but this approach can also be used by brands looking to introduce their proprietary designs to a whole new group of shoppers.

Cons: For wholesale pricing to be sustainable for your business, you must ensure that your sales volume stays consistently high—meaning you’ll have to make sure that the quantity of items in each order meets the minimum required amount.